Today’s investors are changing. Decades ago, investors wanted to see positive profit reports from companies and projections for even more monetary increases in the future. But as the years have passed, investors are shifting their priorities. Now, they want to invest in companies that emphasize ESG practices that build risk resilience and long-term success.

ESG and sustainability are related but refer to two different concepts. Understanding ESG vs. sustainability and how they impact investors’ decisions in today’s markets can help your business follow best practices for positive outcomes.

What Is ESG?

ESG stands for Environmental, Social, and Governance. It is specific and data-driven, making it useful for investors who want to see factual proof that a company is doing what it says it is doing regarding “going green” and being a responsible steward.

Unfortunately, companies can exaggerate their ESG efforts. This practice is known as “greenwashing.” Companies can have values and practices that look good on paper, but proving the effectiveness of these strategies can be difficult. Investors want to reduce risk when it comes to where they put their money.

ESG gives investors an objective framework using verifiable statistics to prove the validity of a business’s environmental, social, and governance efforts. An ESG strategy can also give companies a structure to follow to help them implement the right practices and attract investors whose priorities align with theirs.

To fully understand ESG, you need to know what each dimension covers.

Environmental

When most people think of sustainability practices, they think of the environmental dimension of ESG. This aspect focuses on improving a company’s environmental performance. This can appear in various ways:

- Complying with environmental regulations

- Reducing Greenhouse Gas Emissions and carbon footprint

- Energy Management

- Waste management

- Managing climate risk

- Making efforts to give back to the environment and make a positive difference

The environmental dimension of ESG encompasses balancing the environment, the economy, and equity across all packaging, products, and facilities within a business. It includes energy usage and waste, ensuring a business is taking action to reduce its potential contribution to climate change.

Social

The social aspect takes ESG a step further than other corporate sustainability models. The social dimension of ESG focuses on a company’s impact on its customers, its employees, and the community in which it operates. Here are some examples of social responsibility in businesses:

- Workplace safety

- Labor practices

- Diversity and inclusion in the workforce

- Employee engagement and happiness

- Data protection and cyber-security throughout the business

- Customer satisfaction

ESG’s social component measures companies’ various social activities and disclosures. These factors help investors determine if a company cares about labor standards, human rights, and its employees’ workplace health and safety. The social dimension of ESG also looks at how much a company does for the well-being of its community.

Governance

A business is only as good as its authority network. That is why the governance aspect of ESG focuses on the structure and leadership of businesses, which can include the following factors:

- Leadership diversity

- Leadership compensation

- Code of conduct

- Business ethics

- The shareholders’ roles, influence, and involvement

- How the company handles audits

Investors know that the governing influences of a company directly influence the company’s success and growth. Understanding more about these factors can give investors critical insight into the risk of engaging in business investments.

What Is Sustainability?

Sustainability is a broad term that can encompass a company’s economic efforts towards long-term growth and operational resiliency while aiming to reduce its environmental impact. In addition, social sustainability can refer to promoting gender equality and creating good jobs for people within a community.

Yet, depending on its goals, sustainability can mean different things to different businesses. A company’s sustainability framework is its own concept with its own definitions and sustainability goals. This broad scope and personalized meaning can even leave employees wondering what exactly their business’s sustainability efforts are.

In short, sustainability is a good first step. It shows that a business cares about its influence on the people and the world around it. But its definition can evolve, making it hard for investors to predict a business’s future risk.

The Difference Between ESG and Sustainability

The main difference between ESG and sustainability is measurability. ESG offers statistical, data-driven information that investors can use to truly understand a business’s environmental, social, and governance priorities. On the other hand, sustainability is vaguer, offering little structure to measure in any objective way.

As you read above, depending on its goals, sustainability as a focus area can vary from business to business. This makes it of little use to investors looking to minimize risk. ESG provides specific criteria in the form of environmental, social, and governance dimensions. Third-party organizations exist to offer unbiased ESG ratings that compare different businesses within the same industry. This allows investors to know how a company performs in its ESG efforts.

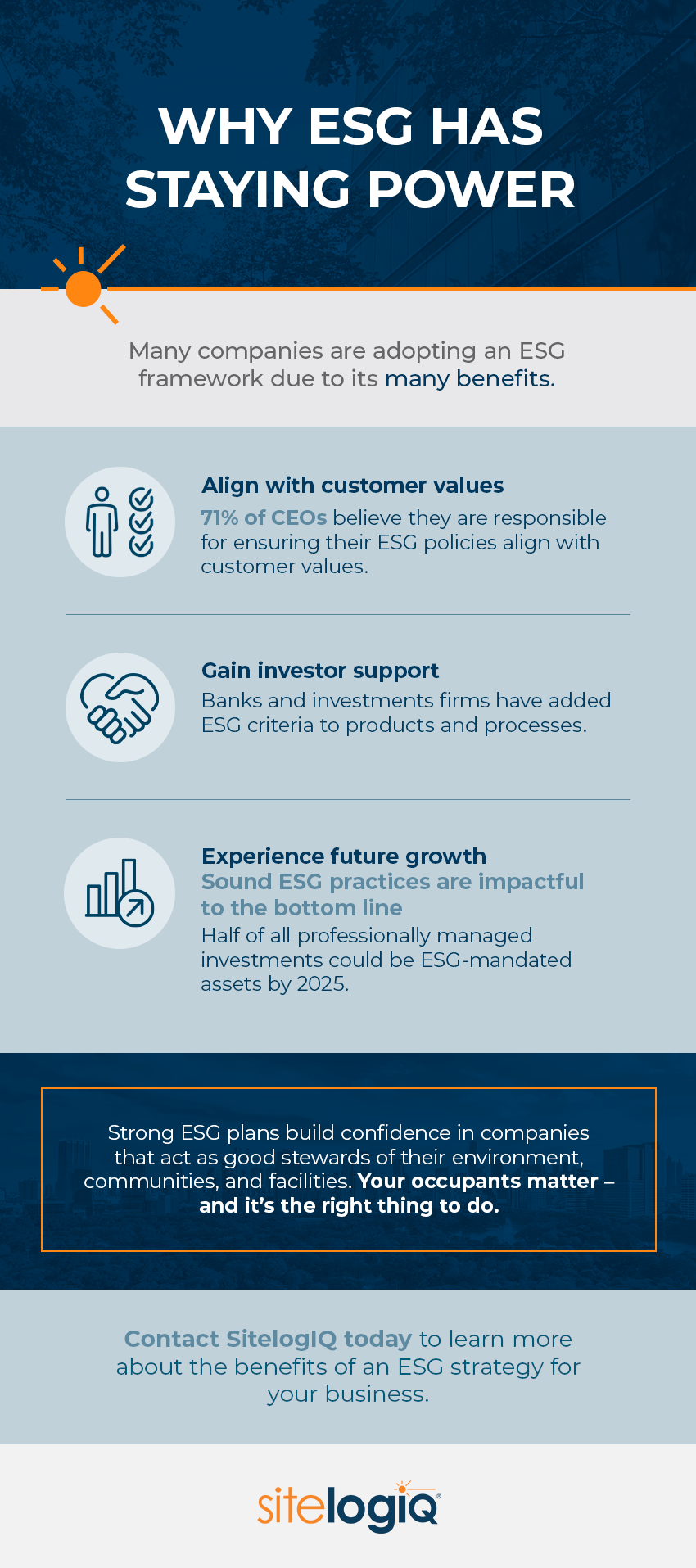

Why ESG Is Here to Stay — Data-Backed Benefits

By now, many companies and organizations are adopting an ESG framework because of its many benefits, including the following:

- Align with customer values: Customers are changing how they shop and the types of businesses they want to support. As a result, companies are changing their approach, and you need to ensure you’re staying in step with the competition. According to KPMG, 71% of CEOs believe they are responsible for ensuring their ESG policies align with their customers’ values.

- Gain investors: Major banks and investment firms like BlackRock have begun adding ESG investing criteria to their products and processes.

- Experience future growth: Deloitte reports that half of all professionally managed investments could be ESG-mandated assets by 2025. This could total $35 trillion.

Choose SitelogIQ to Help You Reach Your ESG Goals

SitelogIQ has the solutions you need to reach your ESG goals. Come to us for our consulting and planning services, and we can help you create an effective ESG strategy for your business. We can also help create a master plan to set you on the right path toward achieving your sustainability goals.

Contact us today to take the next step toward experiencing the benefits of an ESG strategy for your business.