On-site EV chargers have quickly shifted from a nice-to-have amenity to a necessity for multifamily residents. More than one-third of renters surveyed are interested in at-home charging as an amenity and nearly 50% say they are considering an EV as their next vehicle.

While 80% of EV charging takes place at home, an estimated 5% or less of that is at a multifamily property. This is often due to a “charging gap,” which is a top reason some drivers hesitate to make the switch from all-gasoline vehicles.

For multifamily property owners, this demand creates both a challenge and an opportunity. Installing EV charging stations helps modernize your properties, attract and retain residents, move towards sustainability and ESG goals, and boost investor confidence. Still, installing EV charging infrastructure can be costly—between equipment, labor, potential utility upgrades, and the electricity to power stations, these expenses add up.

While there are plenty of low or no-CapEx funding options to reduce upfront installation costs, some multifamily owners may also qualify for Low Carbon Fuel Standard (LCFS) programs for ongoing financial return.

Understanding Low Carbon Fuel Standard (LCFS) Programs

LCFS is a market-based program designed to reduce transportation emissions by rewarding the use of cleaner fuels, like electricity for EVs. Each time electricity replaces gasoline or diesel, it lowers carbon emissions, and those reductions can be converted into LCFS credits.

These credits are bought and sold on a private, regulated market where fuel producers purchase them to offset their carbon output. For EV charging providers, that means turning clean energy use into real financial value.

While California, Oregon, and Washington have active LCFS programs, California is the only state that currently includes multifamily property owners.

California’s LCFS for Multifamily Properties

Under California’s program as of July 1, 2025, multifamily housing property can generate credits based on their EV charger energy consumption. With just the charging data, you can unlock a new revenue stream to offset charging costs, pay for maintenance, or invest in new chargers across any site in California.

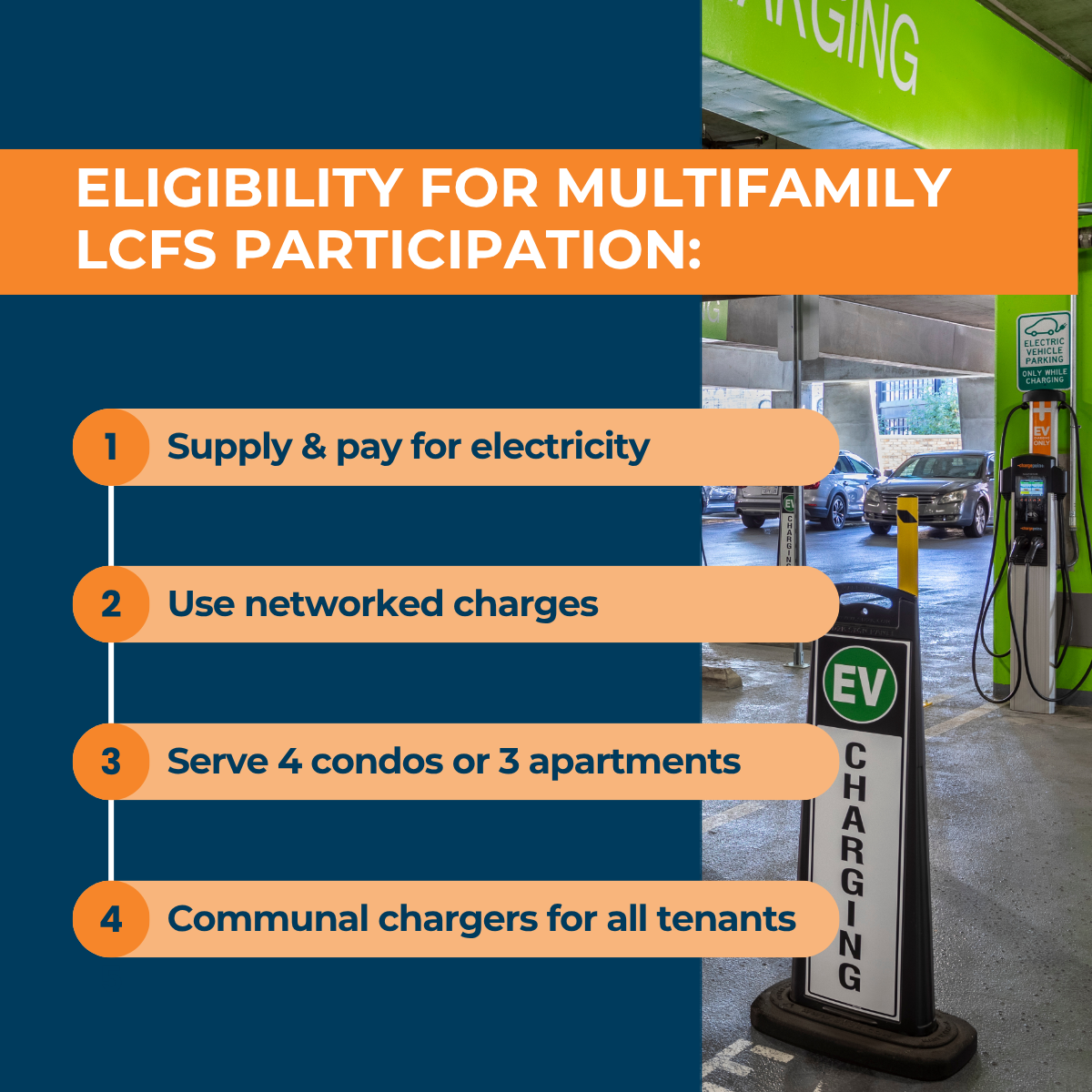

Property owners must:

- Pay for the electricity used by Level 2 or Level 3 chargers.

- Use networked (“smart”) chargers that measure electricity accurately.

- Serve at least four (4) condominium units or three (3) apartment units.

- Offers communal chargers where any tenant can use the charging port.

For qualifying properties, LCFS credits can help offset both installation and operating costs, making EV charging a more attainable and financially sustainable amenity.

Why California Multifamily Owners Should Participate in the LCFS Program

Installing EV chargers at your properties is an investment, and one that often gives property owners sticker shock. But California’s LCFS program changes the math for your properties across the state, turning a long-term investment into one that offers payback quickly.

When residents or visitors charge their vehicles, your property earns carbon credits that can be sold on California’s private LCFS market. That’s a new revenue stream to offset installation costs and utility bills, and to help you allocate budget to other amenities that modernize your communities.

Beyond the dollars, there are additional advantages:

- LCFS credits can recoup part of what you spend on charger installation and ongoing electricity use. It’s a revenue stream that grows as EV adoption rises among tenants.

- The credits you generate have market value. You’re being rewarded for cutting carbon use, with payments that continue for years.

- Renters pay attention to EV charging. It’s a marker of convenience and progress, and it signals that the property is built for where transportation is headed, not where it’s been.

- LCFS participation gives you data-backed proof of emission reductions, a metric investors and residents increasingly expect to see.

- Charging access will soon be a standard expectation. Getting ahead of that curve now protects your property’s relevance and long-term value.

- Every kilowatt-hour delivered through your chargers helps close the state’s charging gap and moves California closer to its clean transportation goals.

LCFS isn’t just a policy program—it’s a bridge between sustainability and profitability. For multifamily owners, it’s a way to modernize responsibly and make the numbers work.

Your One-Stop Partner for Every Step in the EV Charging Process

The buying and selling process of LCFS credits is often cumbersome and can result in a major administrative burden. Having a partner that facilitates these transactions helps to simplify the process and ensures you’re unlocking the full revenue potential of credits.

SitelogIQ partners with FuSE for enrollment and ongoing management support.

In addition to being your consultant and contractor, we’re also a strategic partner that manages all phases of a project from planning and utility coordination to installation and incentive management.

We’re here to help you navigate the entire EV charging installation process. Let’s chat about your needs today.