The passing of the One Big Beautiful Bill Act (OBBBA) brings a wide range of changes across federal tax policy, government spending, and energy-related programs. And many commercial business owners with planned or in-progress energy upgrade projects have questions about its impact.

While the bill covers a lot of ground, a handful of provisions are especially relevant for commercial energy projects, particularly those that rely on federal incentives to lower upfront costs.

For commercial building owners or facility managers involved in capital planning and long-term upgrades, here’s what’s changing:

- Section 179D for commercial energy efficiency deduction ends for projects that begin after June 30, 2026.

- Section 30C, a tax credit for installing EV charging infrastructure, is being phased out.

- Renewable energy tax credits, like 48E, will be fully phased out by the end of 2027, unless supplies are safe harbored by 7/4/26, which allows for full credit if projects are completed in the following four years.

- Commercial energy efficiency tax credits covering upgrades like HVAC are being scaled back or eliminated.

Full details on the legislation can be found here.

It’s understandable that these changes raise questions about timing, eligibility, return on investment, and how to align project goals with shifting policy. Below, we break down what commercial business leaders should know and what steps can help make the most of the time-limited opportunities that still exist.

12 Questions Commercial Business Leaders Are Asking About OBBBA

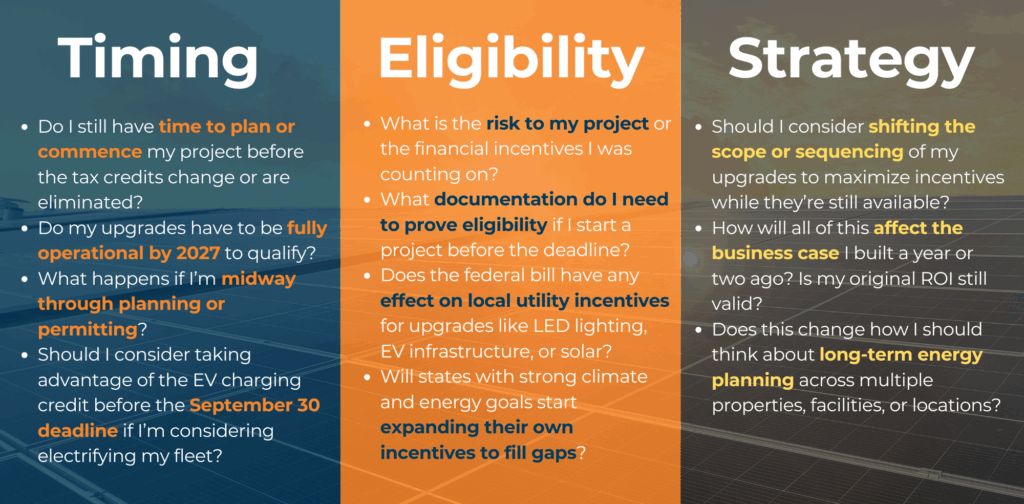

The OBBBA has stirred up a lot of questions—especially for organizations in the middle of planning or rolling out energy upgrades. Some of those questions are centered on timing, while others are about eligibility. Many are simply about what exactly has changed.

Below is a list of the most common questions we’re hearing from commercial building owners and facilities teams.

- Do I still have time to plan or commence my project before the tax credits change or are eliminated?

- Do my upgrades have to be fully operational by 2027 to qualify?

- What does the term “commence construction” mean in the bill? And what counts as “placed in service”?

- What happens if I’m midway through planning or permitting? Do I lose out on tax benefits?

- Should I consider taking advantage of the EV charging credit before the September 30 deadline if I’m considering electrifying my fleet?

- What is the risk to my project or the financial incentives I was counting on?

- What documentation do I need to prove eligibility if I start a project before the deadline?

- Does the federal bill have any effect on local utility incentives for upgrades like LED lighting, EV infrastructure, or solar?

- Will states with strong climate and energy goals start expanding their own incentives to fill gaps?

- Should I consider shifting the scope or sequencing of my upgrades to maximize incentives while they’re still available?

- How will all of this affect the business case I built a year or two ago? Is my original ROI still valid?

- Does this change how I should think about long-term energy planning across multiple properties, facilities, or locations?

Why the OBBBA Is Creating Urgency for Energy Upgrade Projects

If you’ve been considering solar, EV charging, or broader energy upgrades, the OBBA makes one thing clear: The window to act under today’s tax structure is narrowing. There’s still time, but it’s finite.

For commercial business owners or facility leaders who have been weighing the benefits of energy upgrades, now is your time for movement. Even if energy upgrades were on your five- or 10-year horizon, delaying could mean losing access to incentives built to improve ROI and lower upfront costs.

Waiting may cost more than acting—for some projects, you could experience a loss of 30-50% of the upfront costs.

SitelogIQ is your one-stop partner to help you assess, design, and install energy upgrade projects. We have a dedicated team to help you navigate changes and qualify for tax credits before the impending deadlines.

We support all project phases of energy efficiency, electrification, and renewable solutions. One partner, one source of accountability, one comprehensive strategy—across all properties or locations.

With the OBBBA, time is of the essence. Let’s chat about your energy upgrade goals and how you can take advantage of incentives that are still available today.